Are Collection Efforts Damaging Your Customer Relationships?

A Framework for Maximizing AR Efficiency While Nurturing Customer Value

Collections can be a delicate matter. While you don’t want to offend a moderately slow paying customer that buys a lot of product, you may nevertheless have an urgent need to get your money sooner (when due) rather than at a later date. Likewise, having Fortune 500 customers can be a boon, as long as they don’t stretch out their payments too far or whittle away your profits with aggressive payment deductions, especially when your margins are tight.

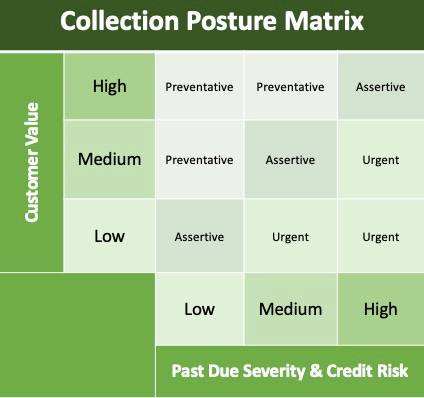

The key is balancing your collection strategy with the lifetime value opportunity of the customer. As a general rule, the greater the potential value of the customer the greater the credit risk you will be willing to assume. Customer value and credit risk combined with past due severity will then inform your collection strategy.

A Collection Messaging Framework

Collections efforts vary widely in format, content, tone and urgency. A call or reminder can range from being:

Customer Service/Preventative: A customer service oriented collection approach, often made before an invoice goes past due, seeks to identify any issues preventing on-time payment of the invoice. Some customers or AP departments may find collection messaging before the due date as an intrusive waste of their time, so this approach needs to be used judiciously—e.g, for large amounts from customers who typically pay late or immediately after the due date for low risk companies.

Friendly Reminder/Assertive: This is simply a gentle reminder of a past due amount. The idea is to ascertain if a problem exists: if so solving it quickly, and if not, securing a promise to pay. Monthly statements fall into this category as do most initial dunning notices.

Forceful Reminder/Urgent: After the Friendly Reminder, collection efforts should increase in intensity. Progressively stronger, more urgent messaging is used to warn the customer of things like future orders being held, reduction in credit limit or loss of credit altogether, escalating to a referral to a Collection Agency if past due amounts have not been paid after numerous attempts.

The strength of the message and collection posture taken, therefore, depend on three key factors:

The long term value of a customer to your company

The severity of the past due accounts receivables (your exposure to that customer)

The customer’s credit risk

These three factors determine how high the risk is of not being paid, juxtaposed against the value of the customer and the posture you should assume when dealing with that customer.

To continue reading and learn how to formulate collection strategies that reflect the value opportunity of your customers, you must be a paid subscriber.

Need help improving cash flow? Besides driving process improvement, the experts at Your Virtual Credit Manager can apply default risk probabilities & other financial benchmarks to your AR portfolio that reveal actionable credit & collection insights.

Readers of Your Virtual Credit Manager can access sharply discounted business credit reports from D&B, Experian, or Equifax through our partner accredit.

Please share this newsletter with your small business customers . . . it just might help them collect faster and pay you sooner.

Customer Value

The large majority of a customer’s value to your company is financial, namely the amount of gross profit margin they contribute in a year. Calculating customer profitability can be a science in and of itself, but simply stated it is:

Net sales (net of deductions and/or credits issued)

Less the direct cost of product and service provided

Less the cost of any unusual level of service rendered to the customer (customization, special handling, hand holding, and so forth). Customer service costs can be estimated, as precise tracking is generally not available.

Other value can be perceived if the customer is a market leader, or your first customer in a targeted industry. You can spend an inordinate amount of time calculating customer value, but if you have the sales volume and a standard contribution (gross margin), it is easy enough to notate the high cost-to-serve customers rather than devise a way to quantify it.

After calculating customer profitability, rank your accounts to identify the top 25 to 50 highest value customers. These “High Value” customers for most firms will account for 50% or more of total gross margin. The next 20% of your customers in the ranking will be your “Medium Value” grouping with the remaining accounts comprising your “Low Value” customers.

Severity of Past Due AR

Severity involves the number of days a receivable is past due while also factoring in the amount of the receivable. The older a receivable, the less likely it will be collected. Therefore a $20,000 unpaid invoice just 10 days past due will in most situations be considered less at risk than a $10,000 invoice that is over 90 days past due.

A good way to estimate severity is to consider invoices under 30 days past due at face value, multiply invoice balances 30 to 60 days past due by a factor of 1.5, multiply invoice balances 61 to 90 days past due by a factor of 2.0, and so on. This estimate of severity allows you to rank your past due customers and then identify those who are low, medium and high.

The accuracy of your estimates is not as important as long as they provide a consistent means of ranking severity. Of course, if there is a legitimate dispute with an invoice that is holding up a payment, that should not be used in your severity estimates or as a reason for escalating collection efforts.

Customer Credit Risk

Credit Risk is an assessment of a customer’s financial strength and its ability to pay you. The weaker the customer’s finances, the higher the probability they will default on the money they owe you. Credit risk is typically viewed in two ways:

Probability of Bankruptcy/Default

Probability of Paying Over 90 Days Beyond Terms

Predicting bankruptcy can be complicated. One reliable predictor of bankruptcy is the Altman Z-Score.

Identifying firms that will pay chronically slow is often easier. Payment references and the payment history section of a commercial credit report will give you an idea of a company’s payment trends. Assessing a company’s Free Cash Flow is another way to identify customers with cash flow problems.

As was done with the previous two factors, using credit risk, the customers can again be ranked as low, medium, or high. For more about credit risk analysis, check out The ABC’s of Credit Evaluations.

Utilizing a Customer Value/Credit Risk Matrix to Program Collection Efforts

By juxtaposing Customer Value rankings against those for Credit Risk and Past Due Severity, it becomes easier to visualize appropriate collection strategies. The following matrix displays the general approach for each Collection Posture outlined above:

Customer Service/Preventative

Friendly Reminder/Assertive

Forceful Reminder/Urgent

Note: Calculate the amount of Past Due Severity and Credit Risk by simply adding them together. The easy way to do this is classify each factor as low = 1, medium = 2, or high = 3. When the two factors are added together the range will then be from 2 to 6, in which case, assign those with a score of 2 or 3 to low, 4 to medium, and 5 or 6 to high.

Identifying your High and Medium Value customers will guide your collection efforts and enable you to optimize the balance between a Collections vs. Customer Service approach for handling past due balances. This provides three major benefits:

By looking at gross margin in addition to the revenue opportunity, it lets everyone in your company know who are the most important customers.

It applies a low effort, cost effective collection approach to your low value customers, so they do not absorb disproportionate attention from your collection efforts.

It identifies higher risk customers that are worth the added collection effort due to their long term customer value.

Here are two examples of how this works:

Many companies offer credit terms to business customers that make relatively small purchases on an infrequent basis. The customer value of these customers is accordingly low. That being the case, you should have little to no tolerance for late payments from this customer segment, which calls for an aggressive collection strategy. In fact, if they continue to cause payment problems you should require payment by credit card at the point of purchase. This will eliminate any collection, as well as credit administration, costs for these accounts—well worth the transaction fee.

Conversely, customers that purchase high volumes are worth more of your attention. Following Pareto’s Theorem, these are often the 20 percent of accounts that drive 80 percent of your sales. The lower risk group in this segment should be handled with a customer service/preventative collection strategy (ideally automated written communications), while those posing high risk and moderate past due volumes require a more assertive collection strategy (a bias towards direct personal contact).

Closing Thoughts…

Building a strong customer relationship will ultimately increase each customer’s value to your company. Building those relationships takes time and effort, which are limited resources. Therefore you need to be smart about it and not waste time and energy, particularly with customers whose value to your firm is relatively minimal or those that will require an inordinate amount of your time and effort.

Customer characteristics need to be identified to the best of your ability during the new customer credit application process and assigned a collection strategy based on that analysis. Over time you will be able to identify customers that require an excessive amount of customer support, thereby reducing their value to your company. Such accounts should be channeled towards credit card or cash transactions, or at least have their credit limit reduced so subsequent orders can be held until any outstanding AR is paid.

By doing this you will free up more time to build strong customer relationships with your higher value customers. You want to make it easy for them to do business with your firm, which reduces their costs and facilitates them paying your company promptly. That’s a win/win situation for both you and your customer.